Although you can have the best bookkeeping system in place, there are still risks that are associated with running a business, particularly with the current state of the Australian economy. If you find that you have run into some debt problems are facing a situation of insolvency Australia, then there are some steps that you will want to take to help alleviate this problem, before you have to declare bankruptcy. The first step is to find a legal team that is experienced with the ins and outs of insolvency and debt collection procedures.

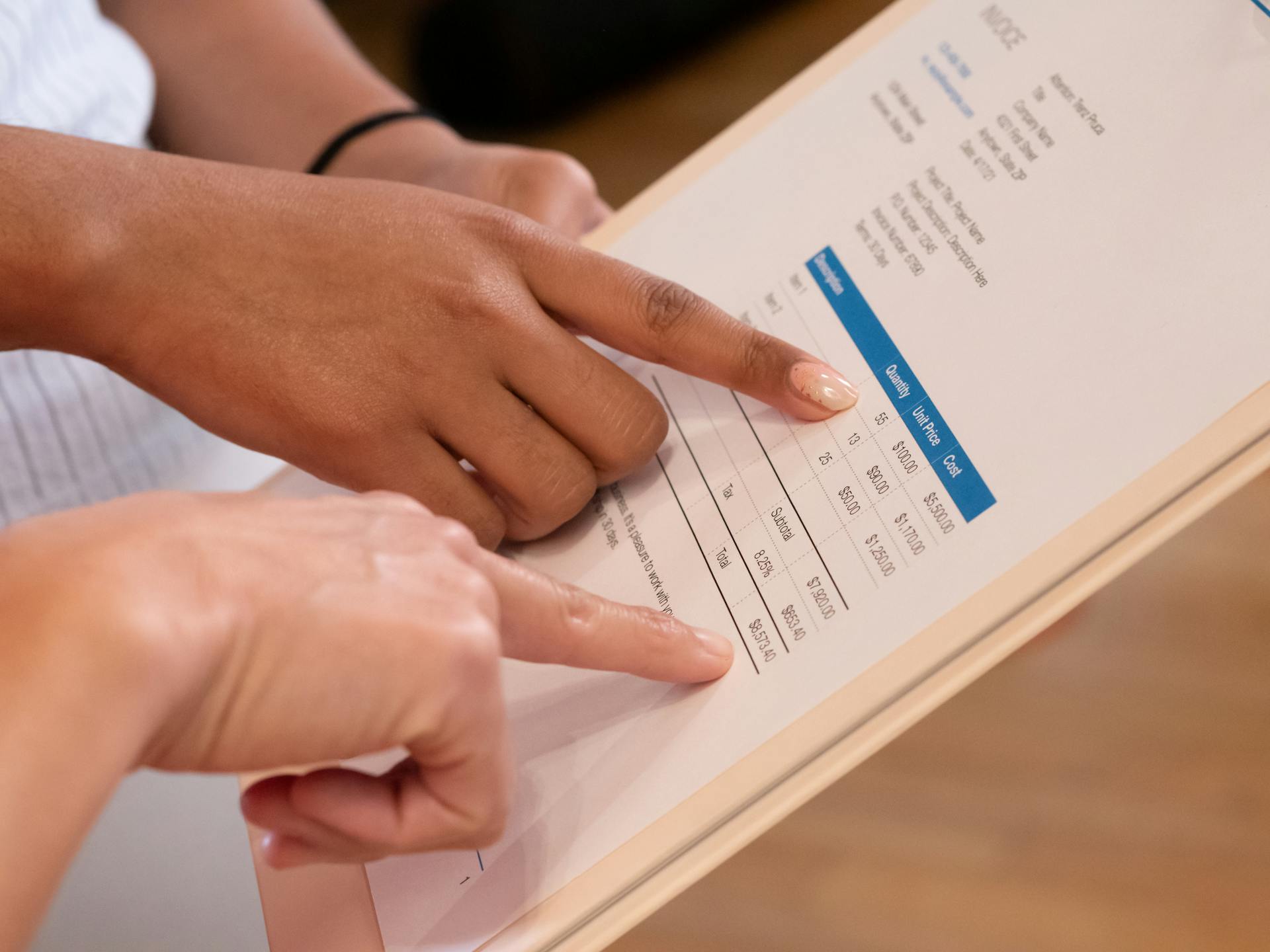

There are two main types of insolvency Australia that you may be suffering from. The first is cash flow insolvency, which is the inability to pay your debts when they are due because you simply are not taking in enough money through your business to do so. The second type is balance sheet insolvency. With this type of insolvency, you do still have assets, but they are not worth enough to counter the liabilities or other debts that you owe, which gives you a negative balance overall in your financial department.

A good first step to deal with insolvency Australia is to consult with your lawyer and have a full audit of your finances to see what you are working with. It may be possible to work out a deal with your creditors to pay them back in smaller instalments, which help keep them from suing you for the remainder of your debt. In other cases, you could potentially settle your debt by paying it all off at once, for a lower amount than what you owe overall. Most creditors are willing to work with those who are struggling to pay the bills, because it is more in their interest to receive some money back than none at all.

Bankruptcy is the final solution for insolvency Australia, although it is not without its risks as well. This could ruin your credit for quite some time, making it difficult or impossible to finance any new business ventures, or to purchase homes, cars, or anything else that would require you to take out a loan. However, if your debts have grown so great that you can think of no other way to legally get out of them, it is definitely an option and has been put in place just for situations along these lines. Be sure to speak to a qualified insolvency lawyer before taking this final step, however, to explore all your other options first.